- Who We Are

- What We Do

- Success Stories

- Careers

- News & Events

- Contact us

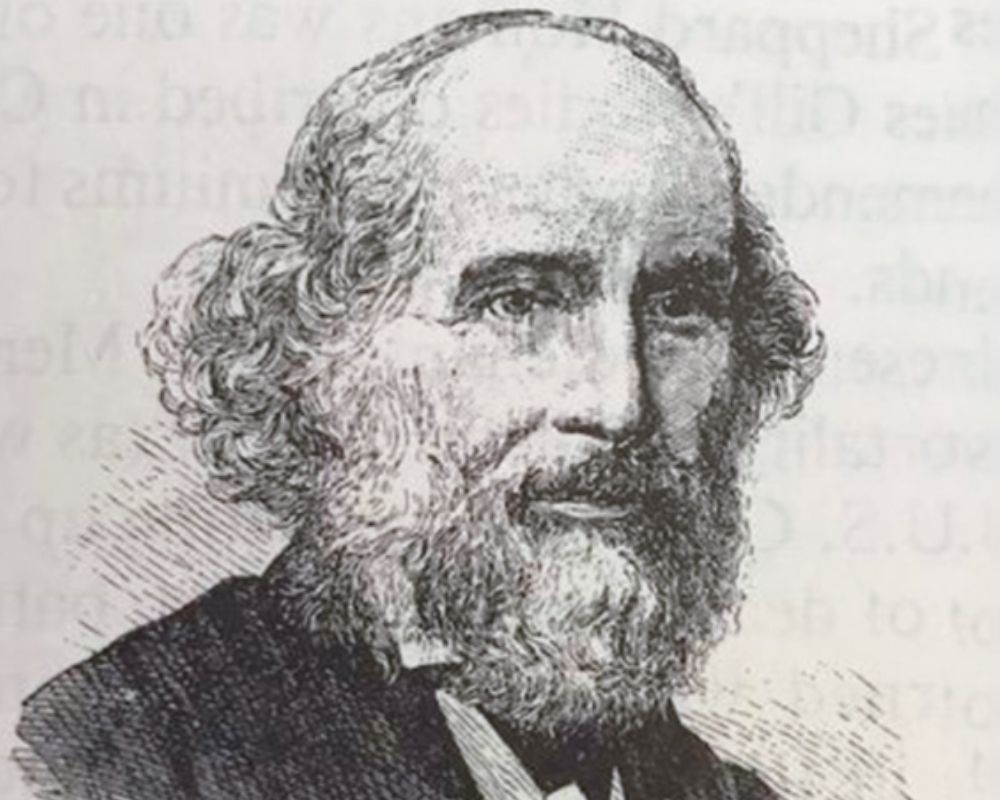

The Father of Life Insurance: Elizur Wright

He was an abolitionist and a mathematician from the United States. He was dubbed “The Father of Life Insurance” or “The Father of Insurance Regulation” in the United States because he advocated for life insurance companies to hold reserves and give surrender values. Also, Wright was a commissioner of insurance for the state of Massachusetts. He was instrumental in obtaining the first law relating to nonforfeiture values of the whole life contract. Wright, early in his career, a New England life insurance firm hired him to assess the values of policies for persons who were unable to continue paying premiums. His reform efforts spanned 40 years. In Massachusetts, where he later became Commissioner of Insurance, the value tables he created were finally mandated by law. Wright was essential in winning a Massachusetts law requiring corporations to record what, if any, was paid in the case of cancelled insurance.

Bit of about his life

Wright was born in the Connecticut town of South Canaan to a devout Christian family with anti-slavery beliefs and a strict sense of morality. In 1810 his family moved to Tallmadge, Ohio, and the younger Elizur worked on the farm and attended an Academy conducted by his father.

Wright came into the writings of William Lloyd Garrison during this time. Garrison’s short book persuaded Wright. Also, Wright created the American Anti-Slavery Society at a convention in Philadelphia in December 1833. He relocated to New York City the same year, with the brother’s Lewis and Arthur Tappan, Beriah Green, Theodore Weld, James Birney, and other like-minded individuals. Wright became the national secretary of the organization for five years. Wright edited many publications, including Human Rights, The Emancipator, and the Quarterly Anti-Slavery Magazine. Also, he was a member of the Boston Vigilance Committee, an organization that assisted fugitive slaves.

Wright and Life Insurance

At age 40, Wright visited the Royal Exchange in London to investigate the life insurance industry. On this trip, he saw an advertisement in the Daily Telegraph for the Sale of 42 Old Life Insurance Policies in which older men were auctioning off their life insurance policies to investors after faithfully paying premiums all their lives. He recognized that these life insurance policy owners were too old to work and could no longer afford their premium payments but were not yet dead to collect the benefit. As a result, the policy owners looked to speculators or investors. Wright recognized and wrote that life insurance policy owners could not obtain as much as half of the value that should be in these policies, but do obtain such from investors in his book Politics and Mysteries of Life Insurance. Wright’s outrage was two-fold. First was the apparent immorality of having a beneficiary invested in seeing someone die. The second was the notion that these men had up to that time been paying premiums yet had nothing to show for that cash investment over the years. Also, he found this disgusting, and upon his return to the United States, he began advocating for a clean-up of the life insurance business, requiring insurers to pay “surrender values” to policyholders on demand and maintain significant reserves to do so.

Wright resolved to do three things

1. Fix the math. After some study and work, in 1853, Wright published what’s credited as the first practical actuarial table reference for the insurance industry. Since Wright realized how easy it was for insurance carriers to cheat, so he devised formulas for calculating the reserves and created statutory capital requirements for the industry. Ultimately, the life insurance industry accepted Wright’sWright’s reforms.

2. Force insurance companies to follow the math.

3. Change the law so that policyholders benefited from the math as well. That meant changing the direction to give policyholders more rights to get back at least some of the cash they turned over to life insurance companies.

Conclusion

Elizur Wright is a person who made wise decisions and who was persevering since sometimes he has failed his plans, but he didn’t stop working towards it. Also, he introduced insurance for the world, for that he was named as the father of life insurance. I believe life Insurance is more important than other insurance, and life is the management seed that can approach anything if it’s secure. Therefore, I firmly believe he has introduced the best solution for the world, which is more important as we live.

Informatics is one of the best solution providers, who provide bespoke software solutions and consultant solutions for Insurance, Banking and Government. Hurry up to get in touch with us. We are looking forward to helping your company to lead in the industry!

Written by Siththy Waseema